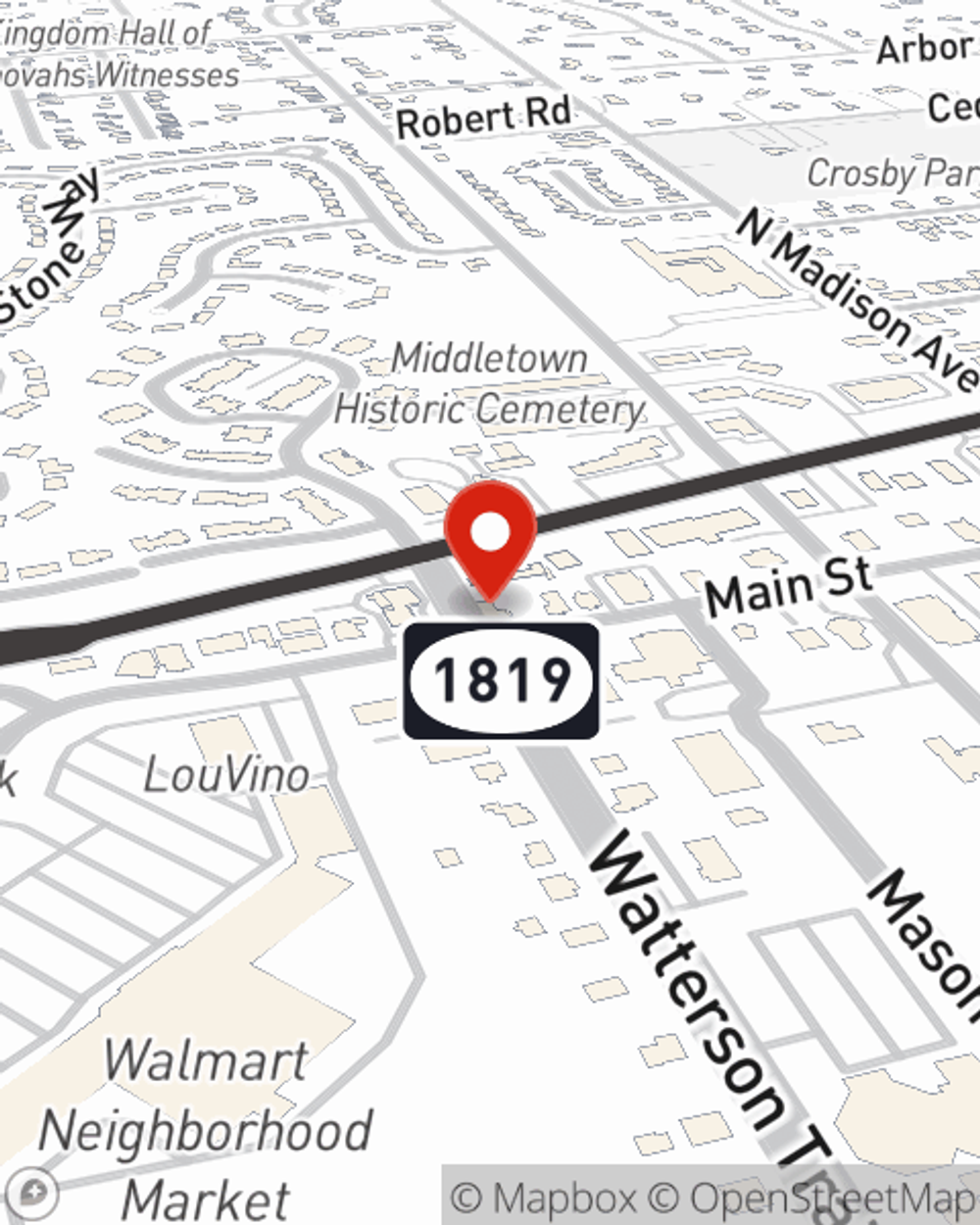

Business Insurance in and around Louisville

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Small business owners like you wear a lot of hats. From financial whiz to social media manager, you do whatever is needed each day to make your business a success. Are you a taxidermist, a surveyor or a sporting goods store? Do you own an antique store, a cemetery or a dry cleaner? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Keep Your Business Secure

Each business is unique and faces a different set of challenges. Whether you are growing a dental lab or a donut shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Tracy Blair Haus can help with errors and omissions liability as well as life insurance for a group if there are 5 or more employees.

As a small business owner as well, agent Tracy Blair Haus understands that there is a lot on your plate. Reach out to Tracy Blair Haus today to discover your options.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Tracy Blair Haus

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.